Bridgend Lifesavers

CREDIT UNION

save. borrow. invest. safely. locally.

Bridgend Lifesavers

save. borrow. invest. safely. locally.

View your account online

Join us now and borrow today

Join us today

Peace of mind needn't cost a penny

Credit unions uniquely insure your savings AT NO COST TO YOU with their Life Savings insurance in association with CUNA Mutual Group. This means that should the unthinkable happen, your designated beneficiary will receive your savings PLUS the insured amount up to a maximum of £5,000. (terms and conditions apply)

We ask all members to name a beneficiary when they join. You can name more than one person, or choose a charity, or can name different beneficiaries for different accounts. You can change your beneficiary at any time, and we ask members to keep contact details up to date.

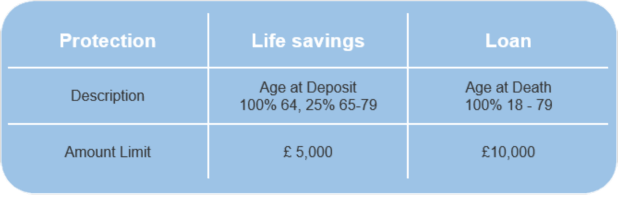

What Does Life Savings Cover? Your life savings insurance will cover 100% of your savings below £5,000 up to age 65 and 25% until the age of 79 to a maximum of £5,000; meaning that should you die our Insurers, CUNA Mutual Group, will match up to 100% of your savings and this amount will be paid to your chosen beneficiary. From the age of 65-79, our Insurers will match 25% of your new savings deposited during these age groups, while still protecting 100% of any deposits made before age 65 and not withdrawn.

When does Life Savings Insurance Not Apply? Any new deposits are subject to a six-month Pre-existing Condition Limitation. This means that should you die from a pre-existing medical condition, any deposits made in the last six months are not covered. Life Savings Insurance does not cover death due to Suicide (within 6 months of the date of deposit), Terrorism or War.

Please note that our Insurance scheme is calculated on age upon deposit – therefore any withdrawals from your savings after the age of 65 will reduce the amount of Insurance received if the funds withdrawn reduce your savings balance to less than £5,000.

LOAN PROTECTION*

What is Loan Protection? Credit unions provide life insurance on your credit union loan AT NO COST TO YOU. This means that in the event of your death, your credit union loan balance is paid off, meaning that you don't need to worry about passing debt on to your next of kin.

This benefit fulfils one of the credit union movement’s core principles - ensuring that a member’s debt dies with them. It is a unique benefit to credit union members and would cost extra with most other institutions.

What Does Loan Protection Cover? Loan Protection insurance automatically covers 100% of the loans held by members aged between 18-79, to a maximum value of £10,000. If your loan amount is higher than £10,000, Loan Protection insurance will cover the first £10,000 of the loan. (terms and conditions apply – please check).

When does Loan Protection Not Apply? Any new loan agreements are subject to a six month 'Pre-existing Condition Limitation'. This means that should you die as a result of a pre-existing medical condition within 6 months of taking out your loan (for which medical advice, consultation or treatment was received), Loan Protection Insurance will not be applied.

Loan Protection Insurance does not cover death due to suicide (within 6 months of the loan data), terrorism or war.

If you have any questions regarding the life or loan insurance, or if you simply want to get further information on what is covered - please contact the us direct by using the details on the Contact Us page above.

While we are not suggesting that this is the only life insurance our members might need, it is a valuable benefit which can help families pay for funeral expenses and other associated costs. It can also be a way to ensure that you are leaving a useful sum of money to your loved ones.

Please ensure that you keep your nominee information up-to-date at all times. If you wish to change your nominee or need to update their contact details please get in touch so we can make the necessary amendments.